Co-authored by Alissa Doherty, Jason Humm, and David Yardley.

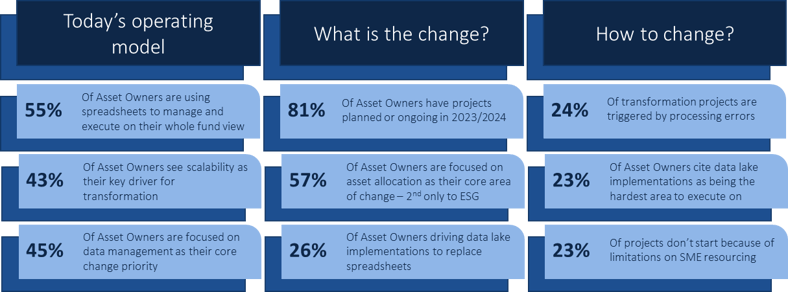

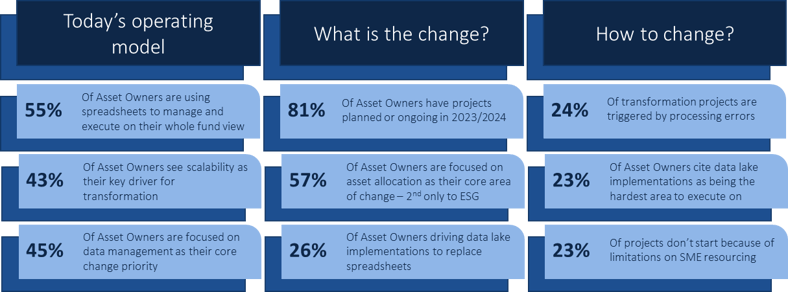

This year, we worked alongside industry partners to distribute a global survey to asset owners delving into changes, challenges, and trends in their operating model and investment operations. Early results from our 2023 Citisoft Asset Owner Survey discovered the following:

- 55% of asset owners are using spreadsheets to manage and execute on their whole fund view

- 57% of asset owners are focused on asset allocation as their core area of change–second only to ESG

- 45% of asset owners are focused on data management as their core change priority

The above survey takeaways reflect what most of us likely know and are experiencing:

- Achieving a centralized view across all asset classes managed by an organization remains extremely difficult. This is primarily due to the challenge of data provision for alternatives and other complex asset types like swaps and bank loans.

- Most organizations are attempting to achieve a holistic view of their portfolios by loading data from disparate sources into either Excel or some form of data warehouse or lake. Unfortunately, loading the data is the easy part. Consolidating, classifying, and reporting on that data remains a huge challenge.

- Asset allocation—a key area of change for 57% of respondents—is currently lacking. One significant reason is because all assets are not in the same place, which makes achieving asset allocation across all portfolios very difficult to achieve.

- Improvements in “data management” are viewed as key in the support of operations. We should define this requirement with slightly more granularity: data consolidation and data classification are really the key—without these the data can’t be accessed or used.

Key factors to achieving a consolidated view across portfolios

What do we need to do in order to solution for the above high-level problems? The focus for many asset owners—and asset management vendors and service providers—is a centralized platform supporting business functionality across all asset classes.

What would we identify as some of our key functional requirements for such a solution? Though this may be an aspirational list, our key requirements would likely include those identified in the table below:

|

Core Requirement

|

Description

|

|

Multi-asset class functionality

|

Support for all asset classes—public markets, derivatives, and alternatives—e.g., allocation, risk management, performance measurement and attribution, reporting

|

|

Centralized, single source of the truth

|

Replacement of current siloed, asset-class based systems with a single, centralized platform across all domains and asset classes

|

|

Timely and accurate data

|

Accurate, timely books of record

|

|

Rich portfolio management toolset

|

Provision of tools to support portfolio analysis and decision-making on the same platform as the centralized, underlying data

|

|

Support for the full investment lifecycle, from front to back

|

Moving from segregated front, middle and back office systems and operational processing to a solution supporting the full investment lifecycle of an instrument or transaction, from start to finish, on a single, centralized platform

|

|

Systemization and automation

|

Elimination of manual processing via utilization of process automation, machine learning, and artificial intelligence

|

Data: the heart of the solution, but the root cause of so many problems…

Drilling down further into the key requirements for a holistic view across portfolios, we can identify data as the core of the required solution. The diagram below depicts the “day in the life” business processing for investment management operations.

As mentioned above, data is also at the base of many of our problems:

Comments